After strong growth in global share markets from June until August, September and early October saw markets retreat. Is this the beginning of a bear market or simply a market correction?

From an investment market cycle perspective, it would seem that it is a market correction, as there does not appear to be extremely over-valued stocks, investor euphoria, overheated economic conditions or other typical symptoms that precede a major bear market.

From an investment market cycle perspective, it would seem that it is a market correction, as there does not appear to be extremely over-valued stocks, investor euphoria, overheated economic conditions or other typical symptoms that precede a major bear market1

The US Federal Reserve continues to taper the bond purchases which are expected to cease in October. In a strong message to investment markets, Janet Yelland, Governor of the Federal Reserve has indicated that they will not be raising interest rates “any time soon”. The approach taken by the Federal Reserve is to ensure that the US economy is sturdily on its own two feet before interest rates are increased.

So how is the US economy fairing? Employment growth continues, existing US home sales rose by 2.4 per cent in September, above expectations2. Other economic data also points to continued improvement with US manufacturing sector growing, retail spending recording solid gains in August (although more subdued in September) and business surveys indicating a strong corporate sector.3

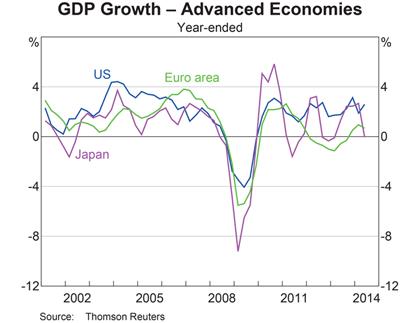

In Europe the news is not as rosy with the European Central Bank lowering interest rates in an effort to stimulate economies. Even the might of Germany, the engine room of Europe delivered reduced industrial production and factory orders. The stronger Euro also put pressure on exports on European manufacturers. In positive news, German unemployment fell to 6%.

As indicated in the graph below, European economic growth is barely positive, and substantially below US growth which has been quite consistent over the past five years.

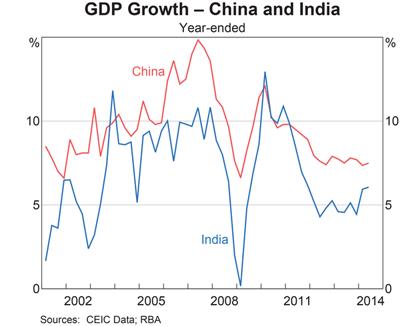

There are concerns that Chinese growth will not reach its target of 7.5% for 2015. As shown in the graph below, although economic growth has fallen from its high back in 2006, these levels were unsustainable. The level of growth has been rather steady for the past couple of years.

Off the back of reduced growth in China, resource prices have fallen sharply since last year.

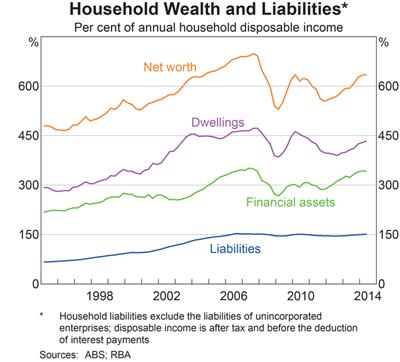

In Australia, residential property prices have been attracting the most attention in the media. Looking over the past 20 years in the graph below we can see that as a percentage of annual household disposable income, housing or dwellings have picked up over the past two years, whilst liabilities have remained steady.

The Reserve Bank of Australia (RBA) is making it clear that it is concerned about the significant pick up in investor driven demand for property, and its effect on property prices. Together with low interest rates and Chinese investors, there are many reasons for the recent large price hikes in residential property particularly in Sydney. The RBA has left the official cash rate of 2.5%, unchanged since September 2013.

The Australian share market strengthened in July and August reaching a peak of 5,650 at the beginning of September, however concerns over Europe, China and the Ebola virus saw markets fall sharply in September (-5.37%) and early October before experiencing a bounce in the second half of October. Other factors that contributed to this recent fall included the continued fall in iron ore prices, and fears that Australian banks having to raise more capital as part of the Murray inquiry, continued fall of the Australian dollar relative to the US dollar and the prospect of higher interest rates coming back into the US economy as the US money printing comes to an end.

The biggest falls for September were experienced by the big four banks which each fell more than 7%.

September was an interesting period for Australian investors in international equities. Whilst the MSCI World Index (local currency) was down 0.85% for the month, when measured in Australian dollars it actually rose 4.3%, thanks to the appreciation of the major world currencies against the Australian Dollar.

The Australian REIT market followed the Australian share market down in September but this follows a very strong year. For the 12 months to 30 September, AREIT’s have delivered 12.28%.

Cash and fixed interest continue to provide moderate returns. As mentioned earlier, the RBA has kept official interest rates at 2.5% and the expectation is that rates will remain at or near this level for much of the next 12 months.

[1] Shane Oliver “Oliver’s Insights – Share Market Correction” 7 October 2014

[2] Sydney Morning Herald, “need2know:Rally gathers pace” 22 October 2014

[3] Shane Oliver “Genesys Market Commentary, October 2014

Global markets delivered mixed but generally resilient outcomes over the December quarter, as investors navigated shifting expectations for interest rates, valuation pressures and ongoing geopolitical uncertainty. Early volatility gave way to steadier conditions toward year end, supported by the US Federal Reserve’s December rate cut and continued confidence in corporate earnings. Artificial intelligence remained a key structural theme, while strength in defensive sectors, commodities, and gold helped balance a more selective risk appetite.

2025 unfolded against a backdrop of heightened geopolitical tensions, shifting central bank policy, and uneven global growth. Markets began the year cautiously, with Donald Trump’s return to the US presidency renewing tariff uncertainty and contributing to early volatility as investors assessed potential impacts on trade, inflation and corporate earnings. Confidence gradually improved as inflation moderated across major economies and expectations for steadier policy settings emerged. A powerful theme in markets was the accelerated investment in artificial intelligence, which became a central driver of global market leadership as the year progressed.

Global markets surged in the September quarter of 2025 driven by optimism around monetary easing and A.I. innovation alleviating earlier concerns over tariffs and slowing growth. Global equities powered higher on a wave of strong earnings, a long-anticipated US rate cut, and continued enthusiasm for A.I. Commodity and credit markets also strengthened, while volatility briefly flared around policy uncertainty and fiscal stress, particularly in Europe, amid a looming US government shutdown.